Nautilus, Inc. (NLS) has been on an absolute tear in 2020. Yet, despite the stock being up +700% YTD, the company still has potential to go many multiples higher. The COVID-19 gym lockdowns have been a tremendous boon for the home fitness company’s financials, but Nautilus has its sights set on much loftier ambitions — a digital transformation. Nautilus is aiming to leverage its rapidly expanding installed base of equipment into annual subscriptions. If they succeed, we could see the company’s value skyrocket from its meager $400M Enterprise Value today.

Heading into 2020, Nautilus was coming off a horrendous year in 2019. Prior management had nearly driven the company into bankruptcy because of a failure to innovate and betting the house on the aging Max trainer product. In Summer 2019, Nautilus picked up new CEO Jim Barr. In Fall 2019, the company released the Bowflex C6 and Schwinn IC4 bikes. The Peloton IPO had just hit the market at lofty valuations, so this was a promising move from new leadership that demonstrated a better understanding of trends in the home fitness market. Priced at a staggering $1,600 less than the Peloton bike, Nautlius was able to provide a much better value proposition to some of the more price sensitive, would-be Pelotoners. This was a brilliant move to get some money flowing into the company at a time when they were severely bleeding out. A lot of work was still in order for the company to replenish financial health and reestablish a path to sustained profitability. But glimmers of hope were beginning to appear.

Then COVID-19 hits. Coronavirus takes the world by storm shutting down the economy and forcing everyone to stay at home. Nautilus stock got punished along with just about everything else in the initial stock market bloodbath. That is, until the investment community began to realize what this “new normal” of living would look like for the fitness industry. With gyms closed indefinitely, every manufacturer of home fitness equipment immediately sold out of just about everything. Now in August, 5 months into the global pandemic, most fitness companies are STILL sold out of many products, and backlogs are piling up. In the first full quarter of COVID lockdowns (Q22020) Nautilus reported $30M of backlogged of orders and 300,000 “Notify me when available” signups for the Bowflex adjustable dumbbells. This was despite a 500% increase in production capacity.

It’s clear now that COVID-19 was an unbelievable black swan event that completely reversed the trajectory of the Nautilus business. Pre-COVID comparisons of the stock and business are now irrelevant. The landscape of the fitness industry has shifted irreparably for the foreseeable future, and there is no doubt that Nautilus is and will continue to be a major benefactor.

Q2 2020—Record breaking Earnings

Nautilus confirmed everyone’s demand expectations for their products during the COVID lockdown when they reported Q2 2020 earnings. Sales came in at $114M, which practically doubled year over year. This surge in sales helped improve their financial position across the board, expanding gross margins, bringing operating income to $22M vs -$13M in the year prior and bolstering the balance sheet with $33M of net cash. Considering the entire company was valued at $48M before the lockdowns in March, this is an astonishing improvement.

The New Normal

When COVID-19 first broke out, the shutdowns were touted as a quick solution to stop the spread of the virus. We’re now 5 months into the lockdown and many aspects of the country, including gyms, are still shutdown or heavily restricted. The duration of this shutdown has done more than send big box gyms hurtling towards bankruptcy–it’s completely changed the landscape of the fitness industry. Nautilus’ Q2 report was the first glimpse at how consumer demand has drastically shifted for fitness products in this post-pandemic World.

Aside from the obvious effects that gym closures have had on home fitness demand, there have also been fundamental changes in how consumers view working out. Mass amounts of previous gym goers have spent the last 5 months reexamining their relationships with their gym. Many are realizing that the commuting, membership fees and crowds are all unnecessary points of contention just to get a work out in. Others remain afraid of re-entering the disease hot bed of a gym in fears of contracting the virus. Now, even as some gyms do reopen, they’re requiring patrons to vie for time slots to get in and then wear masks during the workout. The convenience and safety of an at-home workout is more appealing than ever.

In my view, Nautilus’ Q2 was likely the pinnacle of COVID related sales. However, we will see a slow taper off of those demand levels, not a precipitous drop. Nautilus will likely be operating at elevated levels for Q3 and Q4 of 2020, and their financials will be heavily rewarded for it.

JRNY: The Ace in the Hole

Nautilus’ fitness app “JRNY” is the most under discussed and exciting opportunity for the company. As we saw with the Peloton IPO and Google’s acquisition of FitBit in Fall 2019, as well as Lululemon’s more recent acquisition of Mirror, connected fitness has really started to flex its value in the market. Now that we have a huge transition to at home workouts transpiring, connected fitness is more important than ever.

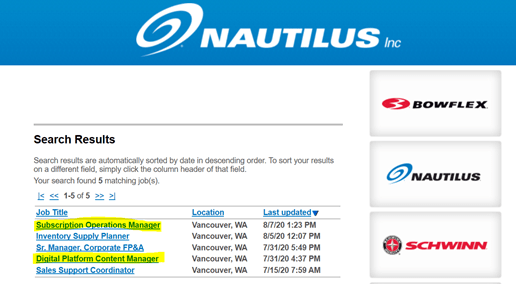

Fortunately, Nautilus is highly aware of the need to capitalize on software. The company’s job postings have recently seen a couple additions in direct relation to the JRNY product. This is a good sign that the company is actively looking to ramp up investment in getting JRNY developed and marketed.

If Nautilus can manage to effectively ramp up the JRNY app and gain subscribers, it will likely command a valuation that is more in line with a SaaS stock instead of an equipment manufacturer. Peloton’s subscription revenue currently only makes up 20% of total revenue, but the company is valued at 13x EV/Sales. Mirror was just acquired by Lululemon for 5x EV/Sales. Meanwhile Nautilus is still sitting at a meager 1x EV/Sales. This demonstrates just how much this market values SaaS and content networks.

Nautilus could see a massive multiple expansion with proven software success. With the addition of a recurring revenue stream from subscriptions, accompanied by a modest 5x EV/Sales multiple, it’s possible that Nautilus could fetch at +$2B valuation, or ~$65/share. This would still put the company at only 1/10th the valuation of Peloton, which is currently sporting a monster $20B valuation.

Nautilus has already announced that JRNY will finally be available on all cardio products in Fall 2020. This is an important development, because up to this point JRNY was only fully available on the high-end Max Trainer equipment. This move now opens the door to a wide array of customers that couldn’t even access it before. Perhaps equally as important, it will also now have Apple Health connectivity. One of the biggest customer complaints was that JRNY did not sync with Apple Health. Apple owns 30% of the wearables market, so this will no doubt be appealing to many potential JRNY subscribers. Building a connection to the tech behemoth could also bear fruit later on if Apple decided to pursue an interest in the Nautilus mission with JRNY.

Partnerships

The connected fitness business was already gaining traction before COVID-19, but it’s hotter than ever now. There’s no doubt a lot of big companies are eyeing the space, and Nautilus is incidentally front and center for the action.

It’s entirely possible that Nautilus gets out right acquired by a big player, but I see a partnership as a much more viable option. The equipment manufacturing side of the business, while hot right now because of gym closures, isn’t a sexy business in the long term. Hence the struggles Nautilus has had in prior years. It isn’t likely that a big tech company wants to take on that headache, as it might end up as a drag on their high margin lifestyles. A partnership on the software side however, makes a lot of sense. The equipment is already in homes, and Nautilus already has the manufacturing in place for more. What Nautilus doesn’t have is the piles of cash required to ramp up software and content creation. For this reason, it’s a mutually beneficial decision for a big player to step in as partner on the software.

Given the relatively miniscule size of Nautilus, a partnership could come from many potential companies. However, recent events seem to be writing on the wall that it may come from Apple. Apple has announced that they will be creating virtual fitness classes in direct competition to Peloton, and could roll out as soon as October this year. Meanwhile, Nautilus has continued to reiterate that exciting new developments and expanded availability are coming for the JRNY product in the Fall of 2020. Seeing as how Peloton closed off their products and platform to third parties, it’s likely that most of these prospective Apple fitness subscribers will be accessing the classes through Nautilus equipment. It’s possible that Apple decides to manufacture their own equipment, but it seems more logical to just capitalize on Nautilus’ already installed base. The announcement of Apple’s classes also dovetails perfectly with the fact that Nautilus has been vocal that their intention with JRNY is NOT to create virtual classes like Peloton. That’s looking like a smart move for Nautilus. Let the big dogs bankroll the content creation and give them the platform to stream it. The biggest risk here is making sure to monetize that. Apple could potentially bypass the Nautilus business and just benefit from their equipment, much like Peloton or Zwift does. However, it seems logical for Apple (or anyone else) to become strategically involved with Nautilus. The financial aspect would be a rounding error for these larger companies and they’d gain tremendous access to the rapidly expanding home and connected fitness market.

Nautilus has massive momentum on many fronts going into the second half of 2020. Equipment sales should remain pretty much maxed out through Winter 2020-2021 and the development of JRNY could become a major catalyst in the mid to long term after that. The global pandemic has ushered in a new era for the Nautilus business. The fitness industry has been permanently altered in some ways, and temporarily in others. In both scenarios, Nautilus is perfectly positioned to capitalize. We could be on the forefront of serious value creation for shareholders.

Any updated thoughts on Nautilus? Blew out earnings, but stock got killed.

Also, subscription revenue appears to still be a non-event….I posted online in a Nautilus forum, and not a single person who owns one of the bikes they bought this year even knows what JRNY is. In fact, they are all just using PTON’s $12/month app on their NLS bike…..

LikeLike

Still early stages of JRNY. Next 6-12 months will be the real test to see if they can gain traction. Now that they actually have cash, business is firing and they have a dedicated/quality JRNY leader, will hopefully become a much better product. Even if equipment owners don’t subscribe to JRNY now, doesn’t mean they won’t in the future (when product is improved)

LikeLike

Hi Patrick,

Thanks for the reply – wish I had ticked the notification box when I made my comment, so I could see the reply sooner haha.

What are your thoughts on this recent price action? I’m a little stunned after that earnings release a week ago. I guess between the PFE and MRNA vaccine news, it became a double whammy for NLS.

A few things that have me concerned right now are (that I wish I had investigated more before making it a large position)….

1. What is the impetus to use Nautilus’s app over PTON’s? When I posted online, a lot of Nautilus owners are just paying the $12/month Peloton subscription and using their Nautilus bike. While it’s great they are owning NLS hardware, you and I know the bigger story here needs to be them subscribing to JRNY as well. I don’t see them switching over to JRNY, unless JRNY will somehow become better than PTON’s app (unlikely). Apple Fitness is going to compete against Peloton with the instructor-led classes, but isn’t this exactly what JRNY is also aiming to do? So they would be competing against Apple as well? If not, then what exactly is JRNY providing that PTON or other subscriptions aren’t?

2. I believe the other thing spooking investors is that shelf offering. There’s chatter on what it could be used for….”potential strategic partnerships on the digital content side.” Have you given this any thought?

3. Looking through the reviews on iOS and Android App Store for JRNY – not pretty. It seems like the overwhelming consensus is, people LOVE the hardware, especially the bikes. They hate the app. Nautilus management really has their work cut out for them in this regard.

4. What are your thoughts on at-home fitness vs. vaccine? First, way I see it, we can bet on American skepticism – I believe something like half of the population has already said they won’t take the vaccine, at least initially. Second, it looks like we will have a very bad 6 months coming up with cases skyrocketing right now before any sort of widespread implementation takes place. Third, gyms in most states have already been re-opened the past few months, and it hasn’t made demand for at-home fitness equipment budge whatsoever. I frankly just don’t think the people who have made the transition to at-home fitness will shift back to gyms likely ever, especially if they don’t need a full free weights setup (power rack, bumper plates, etc.). As in, the ones who are staying away from a gym “waiting on a vaccine” is likely not to overlap a crazy amount with those who are fully onboard the home fitness route?

^ Curious to hear your thoughts. These points above are what keep me up at night regarding Nautilus lol.

The main negative is that they are playing a huge came of catch-up on the software side. The plus is at the current valuation, the market is ascribing zero to negative value for the software business. Even on hardware alone, the stock is cheap, especially considering they stated on the earnings call (if I recall) that they aren’t expecting to be able to even remotely produce enough to meet demand until Q2 2021 at the earliest.

LikeLike