Twitter has come a long way since the micro-blogging service it started out as in 2006. It’s now become the broadcasting medium of choice for World leaders, the premier source of breaking news and an information hub for just about every major topic. Puzzling to many though, is that Twitter’s financial success and popularity still doesn’t come close to matching the value it provides as a service.

In 2020, Twitter still has less than 400 million total users. Only 166 million of these users are considered monetizable daily active users (mDAU), or users than can be shown ads. Compare this to Facebook ($FB) who has about 1.7 BILLION daily active users, about 10 times more than Twitter, and the disparity becomes eye popping.

Much of this size discrepancy can be attributed to the mismanagement of Twitter over the years. While Facebook was making brilliant acquisitions like Instagram and innovating features like marketplace, Twitter has done seemingly nothing to improve the platform. Before rolling out its new “Topics” feature in 2020, the biggest change was doubling the character limit of tweets. Twitter might have even made net negative progress when considering the decommissioning of Vine. TikTok, an almost identical app, recently burst onto the scene and is pulling in private valuations around $75B.

Although the value of Twitter as a service has grown exponentially, it has been a business tragedy since going public in 2013. This mostly explains why the stock is only up 30% in 7 years.

The good news is that investing is forward looking, and Twitter’s future is looking brighter than ever.

How is this site free?

“How is this site free?” has become one of the central memes among Twitter users. It’s often used in reference to comical interactions involving high profile people like Elon Musk or Donald Trump, but it’s broadly applicable to the entire platform. Aside from Twitter’s obvious value as a news service, there are countless experts in all fields that are actively using and providing content on Twitter.

This tweet is a good depiction of the breadth of users on Twitter:

Imagine a list of every single guest that’s appeared on the Joe Rogan Experience podcast. Most are on Twitter, and theoretically, anyone can engage with them. When Spotify announced that they had signed exclusive rights to JRE, their market cap immediately witnessed a gain of $4B despite the deal only being worth $100M. This is a reflection of the immense value that independent expert commentary now has to the public.

For that reason, there is simply no reason why Twitter could not succeed with a subscription service.

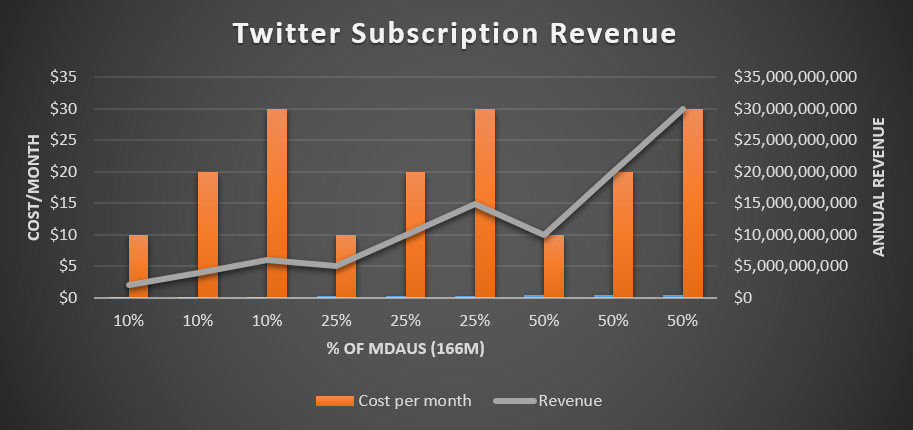

Let’s look at some possible scenarios:

Subscription revenue could mean big business for Twitter. This chart shows the range from only 10% of users at $10/month for $2B of revenue, to 50% of users at $30/month for $30B of revenue.

For comparison, 45% (130M) of Spotify’s monthly active users are subscribers at $10/month. The Wall Street Journal recently surpassed 2 million subscribers paying $20-$40/month. The New York Times has over 4 million digital subscribers now paying $17/month. If people are willing to pay those prices for a single newspaper, what might they be willing to pay for Twitter–the World’s newspaper?

Surely, at least half of Twitter users feel that the service is more valuable to their life than Spotify or a newspaper. If those 50% were willing to pay $30/month (still cheaper than the Wall Street Journal), that would be $30B of high margin, recurring revenue. This would almost 10x their current annual revenue of $3.5B, and most of it would be kept as profit.

Although the high end of these estimates would do wonders for Twitter stock, subscriptions at any reasonable price point would be a meaningful boon to Twitter’s business. Subscriptions are also one of the lower hanging fruits, requiring little innovation to execute.

Advertising

Twitter’s Ad product is notoriously bad. Since social media platforms rely heavily on advertising to make money, this has not been a good look for the business side of Twitter. Fortunately, this shouldn’t be a very difficult problem to figure out. Others like Facebook have already much better advertising capabilities, so it shouldn’t be that difficult for Twitter to acquire the tech.

A lot of eyes will be on Twitter’s new and improved Mobile Application Promotion (MAP) product that is set to debut in the back half of 2020. New activist investors Elliott and Silver Lake were vocal about their focus on improved Ads as well, so we should expect to see improvements on the Ad front.

Twitter has some of the best user demographics across social media platforms, skewing heavily towards highly educated individuals with high incomes. If Twitter can manage to properly target these users with relevant advertisements, the platform will become a much more attractive use of advertisers’ dollars.

Twitter is a search engine

Twitter is the information heartbeat of the world. It is the birthplace of the ubiquitous #hashtag–the universal descriptor of moods, movements and trends. The search module in Twitter is a gold mine of real time updates, commentary and general information. On Twitter, every tweeter is a publisher and search brings you directly to their pieces of micro information.

In the right circumstances, an egg avatar account tweeting updates about police presence in your local neighborhood can be just as valuable as the 100k follower account tweeting platitudes. This differentiates itself from other search arenas like Google, where it is very difficult for a small writer’s information to be seen. As Twitter’s network of users grows, so do the unique perspectives. Every new tweet essentially widens Twitter’s information moat.

Live news and breaking developments is where Twitter’s search feature really shines, but it can also be used for openly browsing topics. If you’re interested in stocks, for example, you can simply search a company’s name or $cashtag to find a slew of research and opinions. Some of the best and brightest people in finance, sports, health, politics, coding or just about any other major topic of interest are on Twitter. Insight into the greatest minds of all domains is just a Twitter search away.

The Content Creator’s Paradise

Twitter is tailor made for content creators. Just about every non-celebrity account with a decent following acquired it by putting out a ton of (usually niche related) content that their audience finds valuable. Twitter users also tend to gravitate towards a handful of topics. This gives Twitter the insights on who’s the most valued in every field. This is great for the creators because it enables them to find and market to their target audience much easier. This is great for consumers because it allows them to find new and valuable contributors in areas of their interest.

In one of its rare innovations, Twitter’s new “Topics” feature actually does a great job connecting its users to valuable contributors on the platform. Topics is a huge plus for the on-boarding and retention process for new users. Now, rather than stammering around the search module to find valuable follows, they are presented on a platter by selecting a topic. Twitter might be able to build on this even further and become a business liaison between creators and the customers they wish to attract.

Price != Value

TWTR Price history Q4 2013- Q1 2020 | Source: Macrotrends.net

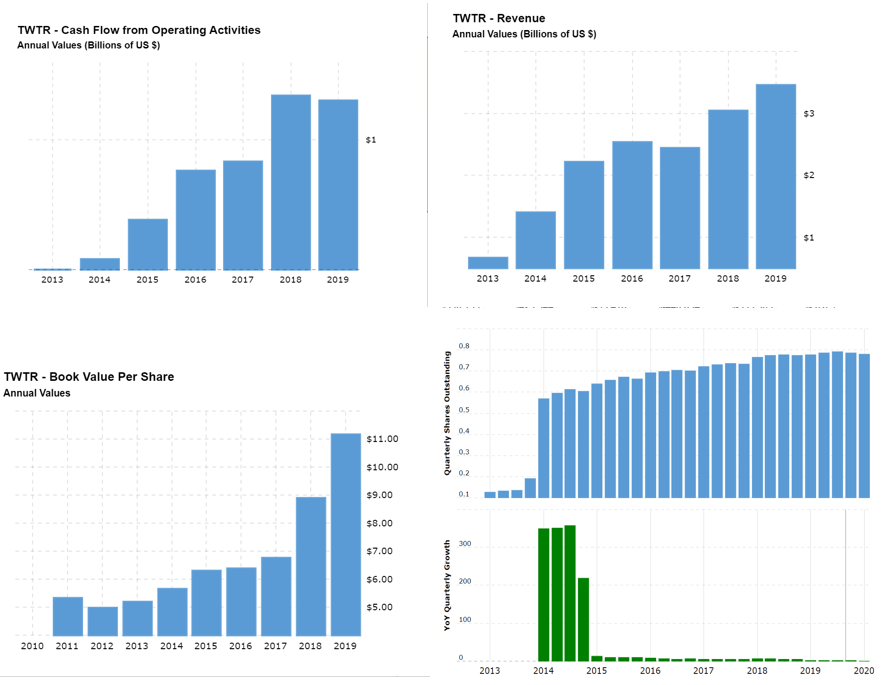

Twitter’s stock has become infamous for its underwhelming performance over the years. Since IPO in 2013, almost 7 years ago, TWTR is up a mere 30%. This pales in comparison to the performance of rival stock Facebook (FB), up +300% over the same time. Even the S&P 500 has crushed TWTR, up +70% since Twitter went public. Twitter has been nothing short of a tragedy for shareholders.

In stark contrast to the stock price, Twitter’s business has actually improved impressively on many fronts. If it weren’t for such heavy share dilution, TWTR would likely be trading many multiples higher than where it is today.

A few metrics from 2013 to today:

• Revenue: + 5x

• Operating Cash Flow: +1,000x

• Book value: + 2x

• Shares outstanding: +6x

Source: Macrotrends.net

Twitter has increased its share count by an astonishing 6x since its IPO. The business has improved notably over time, but operating performance would need to be pretty spectacular to outpace this borderline criminal level of dilution. As an investor, you hate to see it.

Stock based compensation is one of the biggest negatives with Twitter. While SBC has slowed over the years, it unfortunately still hasn’t come to a halt. CFO Ned Segal said on the Q1 2020 earnings call that they “expect SBC to grow sequentially in Q2 by 25% or more”. Newly joined activist investor Silver Lake made an effort to reverse the tides by implementing a $2B share buyback plan. We’ll see if and when that plays out, but personally I would rather see that $2B go into improving the company at the moment.

Twitter has been chronically mismanaged and bled out since going public, but that doesn’t mean it will continue. The platform and business is stronger than ever. The company is not nearly firing on all cylinders, but that is exactly what lends itself to massive opportunity. Every regular Twitter user understands how unique and invaluable the platform is. When you have a product that is highly valuable and at the same time highly addictive as Twitter, massive financial success is never too far off. The discrepancy between service value and company value is quite possibly the largest in the stock market.

An investment in Twitter today boils down to the belief in two things:

- One of the most valuable communication and information broadcasting mediums in human history figures out how to effectively monetize itself.

- That monetization isn’t completely diluted by further share offerings.

Given the numerous avenues available to the company to achieve these ends, and the intervention of seasoned activist investors, Twitter’s future success is looking like a very attractive bet.